The U.S. Supreme Court is currently hearing two cases regarding the legalities of President Biden’s student-loan forgiveness program. The program currently remains on hold after lower courts’ rulings that the plan remains stagnant until SCOTUS makes a final decision.

In August 2022, the Biden administration announced that up to $20,000 of student loans may be eligible for forgiveness for individuals who make less than $125,000 per year. Such an enactment would provide monetary relief to millions of Americans, potentially fully clearing the debt of 45% of borrowers. The proposal led to an onslaught of backlash, and, as of February, the Supreme Court has been challenged by at least six lawsuits regarding the plan, primarily originating from Republican-backed states and organizations.

More specifically, in September 2022, the GOP-led states of Arkansas, Kansas, Iowa, Missouri, Nebraska, and South Carolina, each took legal action in opposition to the proposal in the case Biden v. Nebraska. Their reasoning for such a lawsuit concerned the president’s supposed abuse of authority to cancel out millions of dollars of debt without a formal hearing and decision from Congress. However, the Biden administration claims that the Higher Education Relief Opportunities for Students Act, enacted in 2003, grants the Biden Administration the authority to “reduce or eliminate the obligation to repay the principal balance of federal student loan debt … provided all other requirements of the statute are satisfied.” This act was originally passed after the 9/11 attacks to provide relief for those whose payments may have been affected by the national tragedy. The primarily Republican-led states further their argument by affirming that loan forgiveness would decrease state tax revenue, especially to agencies that help coordinate and process these loans.

In other words, the president’s administration concurred that such authority can be imposed to adjust federal student loans in states of emergency. The United States declared an ongoing national emergency, beginning in March 2020 at the beginning of the COVID-19 pandemic. The Biden administration details that the ongoing health emergency has, in fact, led to adverse financial effects for those who are paying off student loans. They report that if Biden’s forgiveness plan is blocked by the Supreme Court, current students and graduate borrowers would be unable to make their payments on time, increasing the student loan default rate.

The second hearing comes from the lawsuit U.S. Department of Education v. Brown, supported by the Job Creators Network Foundation, an advocacy-based organization with GOP roots. Lawyers for this case are representing student loan users who do not qualify for the $20,000 relief. The plaintiffs claim that they failed to receive procedural rights and were not given a voice for such a proposal. Furthermore, they state that the Biden Administration did not call for public opinion on the plan before it was set in stone and thus, should not extend to those who did not get a say. This is despite the HEROES Act granting the ability to bypass such procedural norms in states of emergency. Similar to the six states, lawyers from this case claim that the president’s enactment is an overstep of his authority.

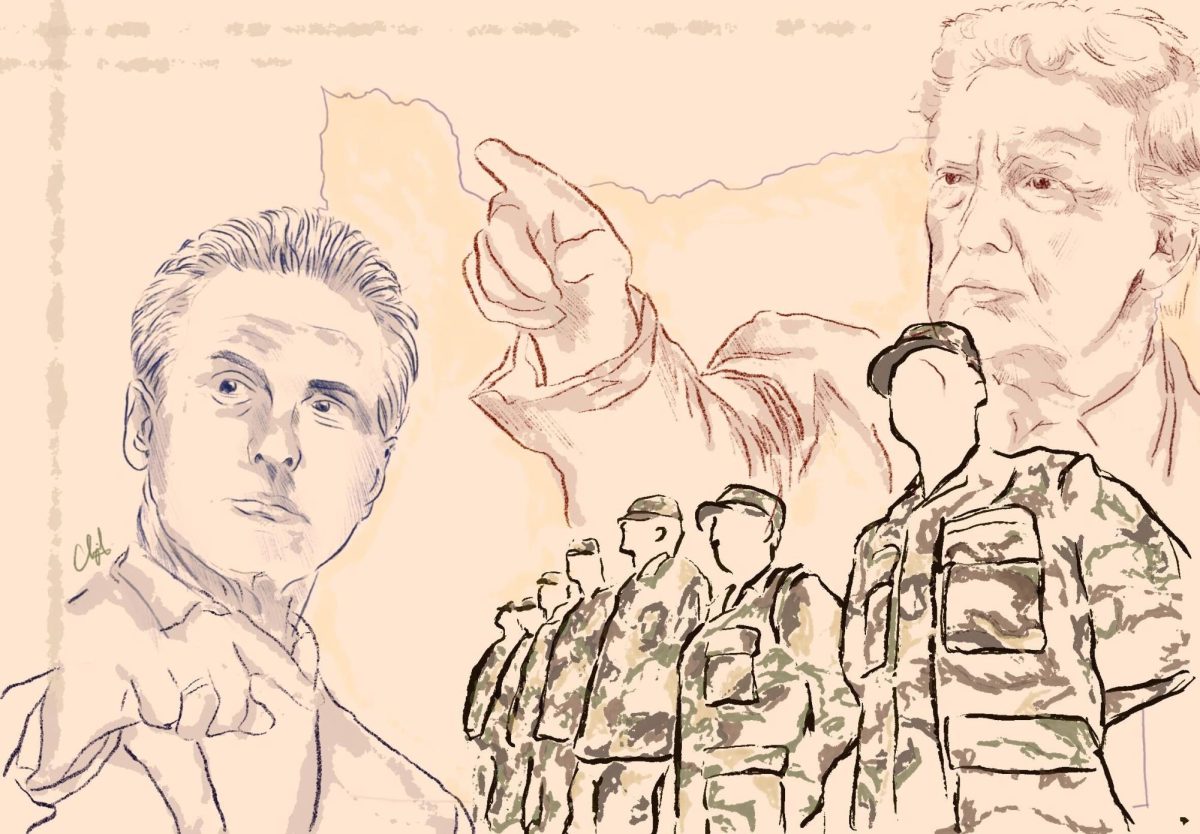

The Supreme Court began the hearings for both lawsuits on Feb. 28. Since its beginning, thousands of demonstrators — many of whom are college-aged students — have protested outside Supreme Court doors in support of Biden’s plan, pushing for the Justices’ agreement. Many of these protesters were also borrowers in debt who attribute the lawsuits to “bad-faith politics” and claim that the forgiveness plan encompasses a good investment in the future workforce.

As of now, Biden has announced an extension in the current student loan payment pause until the lawsuits are resolved, freezing repayments until August. Despite this, millions of borrowers remain in uncertainty, with no clear projection of how such legalities will end.

Photo courtesy of Paul Morigi for Getty Images.