Debt Ceiling Bill to End Pause on Federal Student Loan Payments

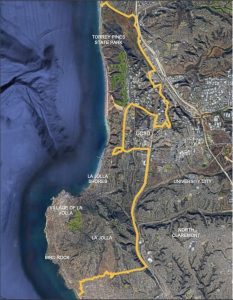

Photo by Allen Chen/ UCSD Guardian

Jun 5, 2023

The House of Representatives approved a bill that will raise the debt ceiling for two years, forcing President Joe Biden to resume collecting student loan payments and interest starting after Aug. 30, after payments were on pause since March 13, 2020.

The bill, entitled H.R. 3746 – Fiscal Responsibility Act of 2023, passed the House of Representatives on May 31, 2023, with 149 Republicans and 165 Democrats voting in favor of the bill. The bill passed the Senate on June 1, 63-36. Biden signed the bill into law on June 3.

The debt ceiling is a limit that Congress imposes on the Treasury department. It caps how much money the federal government can borrow to pay any of its existing obligations, like Social Security, Medicare, military salaries, and other expenses. If the U.S. cannot borrow money to pay off its debt, then it will default, causing downgrades to U.S. credit and possible economic catastrophe. Treasury Secretary Janet Yellen stated in a letter to Speaker Kevin McCarthy (R-Calif.) that the U.S. will run out of money to pay off its obligations on June 5.

Biden and McCarthy reached an agreement to raise the debt ceiling on May 28. The bill contains numerous concessions from both Democrats and Republicans, but perhaps most relevant to recent and soon-to-be graduates is the section which will end the pause on student loan payments.

Director of the Office of Management and Budget Shalanda Young explained what the bill means for people with student loans at a press conference on May 30.

“This bill does end the payment pause,” Young said. “But [it is] very close to the time-frame we were going to end it as an administration, when it comes to repayment.”

The bill does not touch the cancellation of student loans proposed by the Biden administration that is currently pending a decision from the Supreme Court, according to Young.

Earl Warren College senior Michael Wagreich expressed frustration with this section of the bill.

“I think it’s a shame that so many students will be forced into this impossible decision,” Wagreich said, referring to the fact that many students may now be forced to make difficult financial decisions.

The changes to the payment of federal student loans will mean that borrowers will lose the benefits afforded to them from the pause, according to Sarah Turner, Professor of Economics at the University of Virginia.

These impacts have led some students, like Seventh College junior Jared Hoffart, to be disappointed with the final version of the bill.

“[The bill] would be okay if along with it there was a permanent solution to the student loan situation, but if you eliminate the pause on student loan payments that are keeping people afloat with no recourse, you’re putting people’s future in jeopardy,” Hoffart said.

This sentiment is also echoed by Wagreich, who also explicitly called out federal leadership.

“Leaders and decision-making bodies must do more to make sure that financially vulnerable students and populations are protected during these times,” Wagreich said.