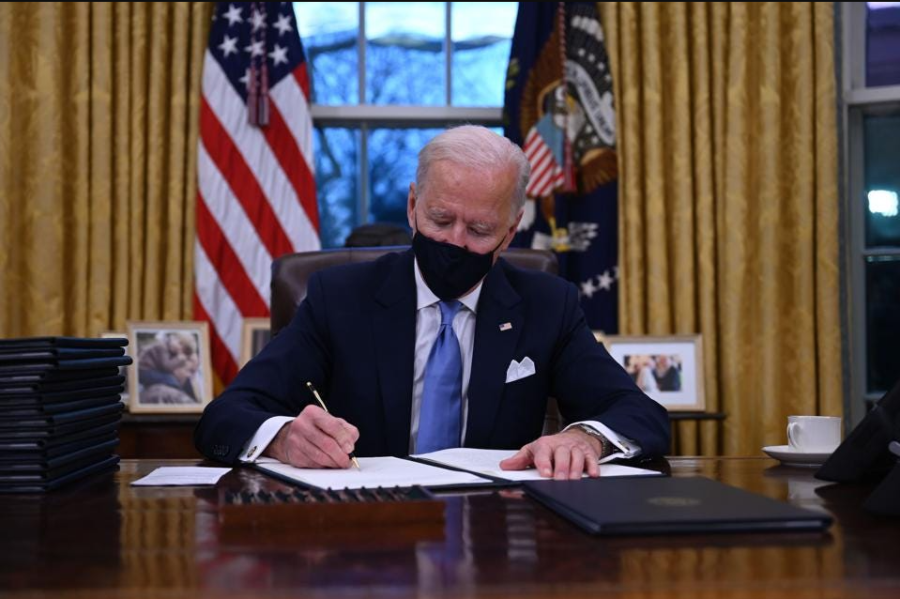

On Dec. 22, 2021, President Joe Biden formally extended the pause on student loan repayment until May 1, 2022. According to the statement, the extension will permit the Biden Administration to assess the impacts of the Omicron variant on nearly 41 million student borrowers, provide more time for borrowers to plan for the resumption of payments, and reduce the risk of defaults after repayment resumes.

“As we are taking this action, I’m asking all student loan borrowers to do their part as well,” Biden said. “Take full advantage of the Department of Education’s (ED) resources to help you prepare for payments to resume; look at options to lower your payments through income-based repayment plans; explore public service loan forgiveness; and make sure you are vaccinated and boosted when eligible.”

All student loan payments and accrued interest have been put on hold since the pandemic began two years ago. The pause was initiated by the The Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2.2 trillion economic stimulus bill signed into law by former President Donald Trump on March 27, 2020.

Loans considered eligible for relief measures are as follows:

- Direct Loans (defaulted and non-defaulted)

- Federal Family Education loans (FFEL) Program loans held by ED (defaulted and non-defaulted)

- Federal Perkins Loans held by ED (defaulted and non-defaulted)

- Defaulted FFEL Program loans not held by ED

- Defaulted Health Education Assistance Loans (HEAL)

Student loans that are not covered under the executive order include non-defaulted FFEL and HEAL loans, Federal Perkins Loans not held by ED (defaulted and non-defaulted), as well as private student loans. If your loan is not eligible for suspended payments, the Federal Student Aid Office advises that you contact your servicers to ask about what benefits may be available.

Some local officials in San Diego see the student loan repayment pause as an essential measure to reduce the economic burden the pandemic has on students and graduated borrowers alike. U.S. Congressman Scott Peters of California’s 52nd District issued a statement to The UCSD Guardian concerning this matter.

“Once the repayment freeze is ended, the Department of Education needs to make it very clear to borrowers what’s expected of them and what they need to do to resume payments,” Peters said. “As your representative, it’s my job to help you and other borrowers to navigate the Department of Education and what your options are to repay student loans, so please reach out to my office if you need assistance.”

Peters also noted some legislative actions on this issue. He emphasized his support of loan forgiveness based on income levels and strengthening income-driven repayment programs, as well as reducing the interest rates, allowing refinancing and allowing people to discharge student loans in bankruptcy. Additionally, he has worked within the House of Representatives to successfully pass bipartisan student loan reduction legislation.

“I support loan forgiveness based on income levels and strengthening income-driven repayment programs, as well as reducing the interest rates, allowing refinancing and allowing people to discharge student loans in bankruptcy,” Peters wrote. “I introduced and passed the only student loan reduction legislation that has become law in the past couple years, which would incentivize businesses to pay off their employees’ student loans.”

UC San Diego has greatly benefited from federal aid since the beginning of the pandemic. Both the emergency financial grants distributed by the CARES Act in addition to the newly established High Education Emergency Relief Fund (HEERF) have aided in the alleviation of financial stress. This fund was created to allow for universities to cover costs associated with the radical changes to scholastic instruction due COVID-19. UCSD was awarded $17,931,499, most of which was dedicated to cover room and board refunds paid to students and a portion of the Return to Learn initiative.

UCSD has one of the lowest student loan default rates in the country, sitting 8 percentage points below the national average of 10%. However, student loan repayment has proved especially difficult during the COVID-19 pandemic. A recent survey conducted by the Student Debt Crisis Center found that 89% of fully-employed student loan borrowers said they financially couldn’t resume payments on the initial end of the loan freeze extension, Feb. 1.

Erika Johnson, the assistant director of university communication for UCSD, said that the loan pause extension will serve as a much needed break for university graduates and their parents and thus minimize the risk of defaulting.

“This is good news for students and parents who currently have loans in repayment status and are in good standing,” Johnson told The Guardian. “It allows students and parents, especially those adversely affected by the current health crisis and uncertain employment situation, to have additional time to adjust to their future financial obligations.”

Johnson also noted that borrowers do not have to pay to receive the delayed payments and 0% interest and students that have taken out loans should be cautious if contacted by non-federally affiliated companies who are offering assistance for a fee.

“The Department of Education will continue to assess the COVID-19 situation and the impact on borrowers,” Johnson added. “As always, students and parents with loans in repayment should be sure to keep current contact information up to date with their loan’s servicers. Borrowers will be contacted when it is time to resume making payments. Keeping loans out of delinquency and default will avoid unwanted financial consequences.”

UCSD students looking for assistance with loan repayment beyond state and federal grants can take advantage of undergraduate scholarships. Continuing undergraduate students can apply to a myriad of scholarships sponsored by UCSD by March 2, 2022 using the Financial Aid Tool via TritonLink. Graduate students —excluding those enrolled in the UCSD School of Medicine —can apply to the 2021–22 UCSD HEERF III Grant Request Form for financial assistance. Requests are considered on a first-come, first-served basis.

Those seeking more information concerning loan repayment can refer to the Department of Education’s website or Federal Student Aid office directly for official information about the extension. Additionally, those seeking assistance from Rep. Peters’s office can email him directly through a portal on his website.

Photo taken by Jim Watson for Getty Images

Ronald Ruiz • Jan 10, 2022 at 1:01 pm

Thank you for the information, good to keep up to date with what is happening at UCSD.